*I am not a financial advisor & recommend you do your own research before investing*

I invest using three “buckets,” of funds each with a unique purpose & utilizing a separate account (mostly to try out different brokerages but also to avoid the temptation of commingling funds):

- Roth IRA using Vanguard

- Additional Index Fund Investments utilizing M1 Finance

- “Fun,” or “Speculation” account utilizing Robinhood

Diving in:

I live by the adage, “pay yourself first.” Like many things in life, consistency is one of the main components of successful investing. Every single time I receive a paycheck (no matter how small or large), I transfer 10% of the amount to my investment accounts before doing anything else (as an independent contractor my monthly income varies. However salaried employees could commit to investing a certain dollar amount every paycheck or every month instead of a percentage. This can be automated for even more convenience). Over time, as my income grows, my plan is to increase this automatic investing percentage instead of letting lifestyle creep set in (allowing your spending to rise in correlation with additional income).

Here is how I allocate & invest the 10%:

- Max out tax advantage accounts — Tax advantaged accounts allow your investments to grow free from the weight of capital gains tax. Pre-tax accounts (like a traditional 401K) allow you to defer income tax in the year the investment is made. With post tax accounts (like a Roth IRA) you pay income taxes the year you invest (and are therefore investing “post tax dollars”) but do not need to pay any income tax in the year you withdraw the money. Deciding between the two types of accounts largely depends on your current income tax bracket and the tax bracket you expect to be in during retirement. Because I am an independent contractor & am in the earlier years of my career (lower tax bracket) I choose to invest in a Roth IRA (If I had access to a 401K with employer match offered this would be the first place I would invest — Employer contributions are free money! If you have access to such an account and are not contributing, I highly suggest starting now).

- I use Vanguard for my Roth IRA account but most brokerages offer this type of account. Roth IRA’s have the following features + limitations:

- $6,000 max annual contribution (but principal can be withdrawn at anytime tax free — for early stage investors this flexibility is amazing! If an emergency arises you do not need to worry about paying exorbitant fees to get your money back like you would with traditional investment accounts).

- $130,000 annual income limit to be eligible for Roth IRA (there are “backdoor,” methods and workarounds if you cross this threshold).

- You can use the funds within your Roth IRA to invest in almost any asset class. The most common are stocks & bonds but you could also invest in real estate, bitcoin, or precious metals (these later asset classes would require utilizing a custodian).

- My account is invested almost wholly in Vanguard’s 2050 Target Retirement Account — VFIFX. This is a low cost mutual fund (.15% expense ratio = for every $1,000 invested I pay $1.5 annually) that automatically reallocates as retirement approaches (from stocks and aggressive growth earlier in the life of the account to bonds and more stability as the target date approaches). VFIFX is made up of 4 Vanguard mutual funds:

- VTSAX (total market fund – 3680 stocks) = 53.6% (.09% expense ratio)

- Microsoft – 4.2%

- Apple – 3.7%

- Amazon – 2.7%

- Alphabet – 2.7%

- Facebook – 1.6%

- Berkshire – 1.4%

- VGTSX (total international market fund) = 35.9% (.17% expense ratio)

- Alibaba – 1.5%

- Nestle SA – 1.3%

- Tencent – 1.2%

- Taiwan Semiconductor – 1%

- Samsung – 1%

- VTBIX (total bond market II) = 7.5% (.09%)

- Treasury – 44.4%

- Government Mortgage Backed – 21.5%

- Finance – 8.4%

- Foreign – 4.9%

- Commercial Mortgage Backed – 2.1%

- Utilities – 2%

- Asset backed – .4%

- VTIBX (total international bond) = 3% (.13% expense ratio)

- Europe – 57%

- Pacific – 25.4%

- North America – 9.4%

- Emerging Markets – 4.7%

If this seems too complicated or is more than you want to think about, DON’T WORRY! The best part is Vanguard does everything for you. All you have to do is consistently contribute.

- Invest in additional Index Funds via mutual funds or ETFs (in Taxable Accounts)—Once I have maxed out my Roth IRA contributions for the year ($6,000), I continue to invest in Index Funds (which I feel is safer than investing in individual companies). This can be done via mutual funds (such as the Vanguard Funds listed above) or via Exchange Traded Funds (ETFS). There are several technical differences between the two methods (such as tax efficiency & method of origin) but for most lay investors, the main difference is mutual funds are purchased directly from the issuer (AKA a Vanguard mutual fund is purchased from Vanguard or a Fidelity mutual fund is purchased from Fidelity) and can be purchased in any incremental dollar amount, while ETFs are available from most brokerages (including Robinhood, M1, Webull etc) but can only be purchased in increments of their share price (however even this difference is beginning to blur due to the increasing popularity of “fractional shares,” & share “slices”). Most mutual funds also offer an ETF equivalent.

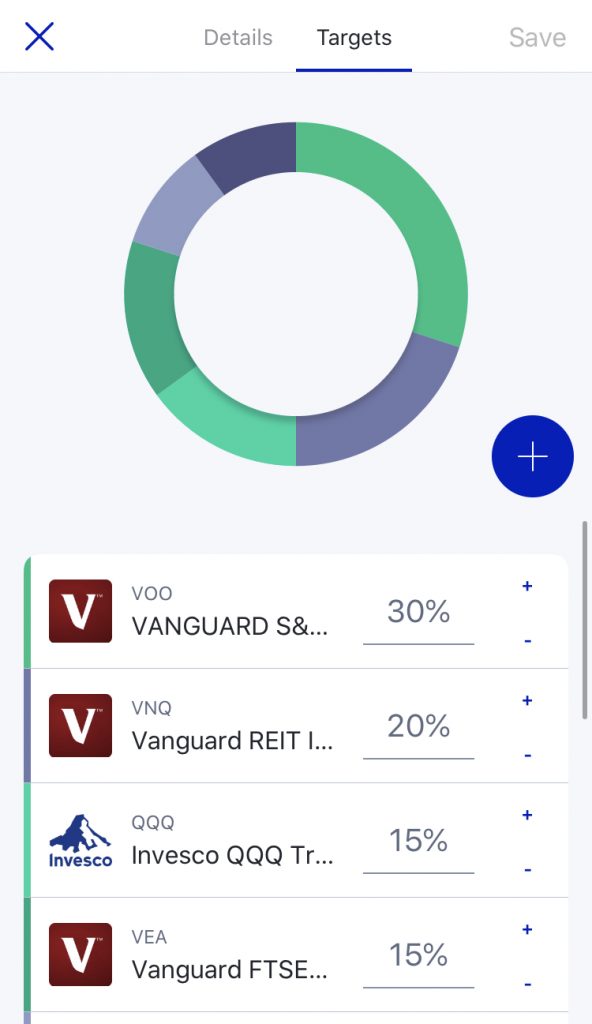

- What sets M1 apart is the ability to create indexes or portfolios of your own. To do this you select the stocks or ETFs you want to invest in & set an allocation percentage for each. Moving forward any dollar contribution will be spread out based on your allocation.

My M1 Portfolio Targets:

- 30 % — VOO (S&P 500 ETF) 509 holdings – (.03% expense)

- 20 % —VNQ (Vanguard Real Estate Investment Trust Index Fund) 184 holdings – (.12% expense)

- 15 % — QQQ (Invesco Nasdaq Index Fund) 103 holdings – (.2% expense)

- 15% — VEA (Vanguard FTSE Developed Markets – Canada, Major European & Pacific Regions) 3949 holdings – (.05% expense)

- 10 % — VUG (Vangaurd Large Cap Growth) 239 holdings – (.04% expense)

- 10% — VWO (Vangaurd FTSE Emerging Markets excluding South Korea) 4177 stocks – (.1% expense)

Right: Robinhood Portfolio Home Screen

- Have a completely separate account for speculating — One point that the legendary investor Benjamin Graham makes several times over in, “The Intelligent Investor,” (My summary series of the book can be found here) is that most people cannot avoid the temptation to speculate completely (that is to invest in companies for a reason other than their underlying book value). Instead, Graham suggests setting aside a small portion of funds for these actives. For this purpose, I utilize Robinhood. I love the look & feel of the app (though it lacks some advanced research tools) and utilize the account to invest in individual companies as well as crypto currency (which I would certainly categorize as a speculative venture).

- This account is NOT funded with the original 10% contribution. I will typically allocate a smaller % for this purpose — Such as 3% of each check. If I have extra funds after my normal monthly expenses I may choose to allocate additional funds here as well.

To summarize, my recommendations are:

- Start investing now. Small consistent contributions add up over time.

- Set aside a small portion of every paycheck before expenses to invest (pay yourself first)!

- Utilize tax advantaged accounts when possible.

- If you enjoy day trading, cryptocurrency or speculating on risky assets, that is OK — But make sure these activities make up a small portion of your overall investment portfolio & do so with a separate account from your main holdings.