Chapter 10: The Investor and His/Her Advisers

“Indeed she gave him or her good counsel, to look rather to himself than to the sky.” — Michel de Montaigne

- The reason most people invest is to make money. Therefore asking for investment advice is asking others how to make money. This is strange dynamic as most business people seek professional advice on various aspects of their business but NOT how to make a profit

- Much bad advice is given free

- Investments require some level of personal control — However investment advisers can provide experience, judgement and a second opinion which can be just the psychological boost an investor needs

- Reasons to seek out professional management assistance:

- Big losses (worse than the overall market)

- Busted budgets (you don’t know where your money goes)

- Chaotic portfolios (no discernible strategy)

- Major changes (employment changes, kids, etc)

- Steps to selecting an Advisor

- Trust then verify — Ask those you trust for recommendations

- Understand the advisors speciality (stockbroker, financial planner, accountant)

- Research the advisor & their company online looking for any complaints or disciplinary actions

- Meet with & get to know the advisor and their incentives:

- Do they seem to care about helping clients or do they simply go through the motions

- Do they understand the fundamental principals in this book

- Are they sufficiently educated, trained & experienced to assist

- Questions to ask:

- Besides alarm clock what gets you up in the morning?

- What is your investing philosophy?

- What do your clients typically have in common?

- How can you help me reach my goals?

- Do you accept third party compensation when making investment recommendations?

- What is your proudest achievement with a client?

- What do you think is a reasonable annual return (anything over 8-10% is unrealistic)?

- A good advisor should also ask you similar questions and make sure you are a fit as a client

- Sources of investment advice:

- Investment Counsel and Trust Services of Banks

- Today typically reserved for investors with more than $1M in financial assets

- Most are modest in their promises and pretensions

- Typically place clients funds in standard interest and dividend paying securities

- Primary goal is conservation of principal & conservatively acceptable rate of return

- Financial Services (Such as Moody’s, Standard & Poor’s etc)

- Can be good source of information and suggestions but should be taken lightly

- Lower fees than investment counselors charge their individual clients

- Typically offer information & guidance to those directing their own funds (unlike investment counsel firms who frequently take on very active role & relieve their clients of decision making)

- In Graham’s view, advisory work from these firms is often impaired by the view that stocks should be bought if the near-term prospects of a business are favorable & sold if they are unfavorable — regardless of the current price

- This prevents firms from a sound analytical approach that decides if a stock is currently over or undervalued at its current price in light of its indicated long term future earning power

- Advice From Brokerage Houses

- Brokerage Houses are members of the exchanges (such as NYSE) and execute the buying and selling of shares for a standard commission

- Provide the largest volume of information & advice to security owning public

- Are in business to make commissions — Geared towards day to day trading & give the customer what they want. Cannot be counted on for unbiased advice (best you could hope for is for the brokerage house to refrain from encouraging speculation)

- Two types of employees:

- Customer’s Brokers (account executives): Commission oriented & therefore speculation minded. However if given explicit instructions & a “investor,” framework will respect and cooperate with your viewpoint

- Financial Analysts: Works up detailed studies of individual securities, compares issues within same field, & forms an expert opinion on attractiveness/intrinsic value of different kinds of stocks and bonds

- Value of securities analyst to investor depends on the investor’s attitude and ability to ask the right questions

- Investment Bankers

- Firms that engage in the originating, underwriting & selling of new issues of stocks & bonds

- It is here that finance plays its constructive role of supplying/deploying new capital for the expansion of industry

- Intelligent investor will listen to the advice and recommendations of investment banking houses but exercise independent judgement. Typically these firms conduct themselves honestly and their underwriting is well scrutinized. However beware of where priorities lie

- The aggressive investor works in active cooperation with their investment advisors. They listen to their recommendations and ideas and then pass independent judgement

- Regardless of how involved you are with your investments or how many advisors you have make sure you have & understand the following:

- Comprehensive Financial Plan: How you will earn, spend, borrow and invest money

- Investment Policy Statement: Spells out your fundamental approach to investing

- Asset-Allocation Plan: Details how much money you will invest in different asset categories

- Investment Counsel and Trust Services of Banks

Chapter 11: Security Analysis for the Lay Investor — General Approach

“In 44 years of Wall Street experience and study I have never seen dependable calculations made about common-stock values or related investment policies, that went beyond simple arithmetic or the most elementary algebra. Whenever calculus is brought in, or higher algebra, you could take it as a warning signal that the operator was trying to substitute theory for experience , and usually also to give to speculation the deceptive guise of investment.” — Benjamin Graham

- Security Analysis: Examination and evaluation of stocks & bonds

- Financial Analysis: Adds determination of investment policy + general economic evaluation

- The more dependent a valuation is on anticipations of the future instead of historical data the higher the likelihood of miscalculation and serious error.

- Security Analysis begins with interpretation of a company’s annual financial report.

- Bond Analysis: The most dependable and therefore respectable branch of security analysis:

- Earnings Coverage Test — How many times fixed debt charges have been or can be covered by earnings. In high interest rate environments Graham suggest’s looking at percent earned on the principal amount of the debt as an alternative:

- Size of Enterprise — Volume of business

- Stock/Equity Ratio — Ratio of the market price of the common stock to the total face amount of the debt + preferred stock

- Property Value — Asset values as shown on the balance sheet

- Earnings Coverage Test — How many times fixed debt charges have been or can be covered by earnings. In high interest rate environments Graham suggest’s looking at percent earned on the principal amount of the debt as an alternative:

- Common Stock Analysis: Ideally determining a valuation of an issue which can be compared to the current price to determine if the security represents an attractive purchase

- Ideally, a security analyst would pick the three of four companies whose future he/she thinks they know best and concentrate his/her efforts + clients interests here. However it is almost impossible to distinguish in advance which individual forecasts can be relied upon and which are more prone to error

- “For it is undoubtably better to concentrate on one stock that you know is going to prove highly profitable rather than dilute your results to a mediocre figure, merely for diversification’s sake. But this is not done, because it cannot be done dependably.”

- Valuation is typically calculated by estimating average earnings over a period of years in the future & multiplying by appropriate “capitalization factor” (or earnings multiplier)

- A scientific stock evaluation would need to account for future interest rates (as this would affect net present value of future earnings + dividends) but this proves very difficult to do with any degree of confidence

- Factors affecting capitalization rate:

- General Long Term Prospects: Start by reviewing 5 years of annual reports (form 10-K) ask ask, “What makes this company grow,” & “where do (and will) its profits come from”

- Be weary of:

- “Serial acquirers,” (more than 2-3 companies per year). If a company would rather buy the stock of other companies than invest in itself it may be a sign that the intelligent investor should as well

- “OPM addicts.” Using Other People’s Money excessively through “cash from financing activities,” can show misleading growth & mask an unhealthy company

- Companies lacking diversified revenue streams (relying on one company or a few select companies for all revenue)

- Look for:

- Companies with a large “moat,” or competitive advantage (monopoly, strong brand identity, unique intangible asset, etc)

- Companies with long term consistency (marathon not a sprint — 10% pretax is likely the highest sustainable annual growth rate)

- Strong commitment to Research & Development spending

- Management: Be careful not to over count this figure as good management will show up in past positive results & is implied in future positive results/ long term prospects. Be weary of companies that reprice options for insiders, pay exorbitant executive salaries without justified reason, or have executives that make frequent & large stock sales.

- Financial Strength and Capital Structure: Namely, does the company produce more cash than it consumes. Long term debt should be under 50% of total capital. Start with reviewing the companies statement of cashflows. Then consider what your cash in hand would look like at the year if you fully controlled the company. Relatively little common stock in relation to bonds and preferred stock may create the opportunity for large speculative profit in the common (known as leverage)

- Dividend Record: 20+ years of continuous payments is ideal

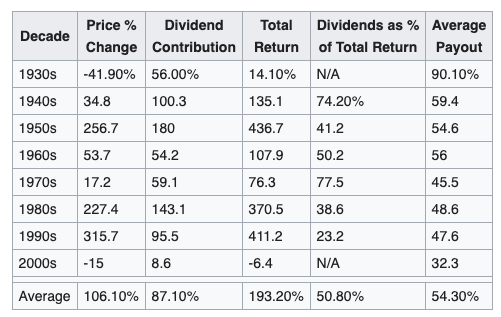

- Current Dividend Rate: Keep in mind many growth companies will not pay a dividend. In this case, the burden of proof is with the company to show that the investor is better off reinvesting the funds than receiving a dividend

- Factors affecting capitalization rate:

- Capitalization Rates for Growth Stocks:

- Value = Current (Normal) Earnings X (8.5 + 2(Expected Annual Growth Rate))

- High growth stocks must be valued cautiously. If 8% annual growth or higher were to be achieved indefinitely, the future value would be indefinite

- Industry Analysis: Economic position of the industry & of the individual company within its industry

- This research is generally already priced into the market but can provide insight if the findings are novel or not well understoodHere the investor must balance the ability to make big profits by being imaginative and having a unique vision & the substantial risk of miscalculation this thinking brings

- A Two Part Appraisal Process:

- Determine the, “past performance value.” This is the value of a stock assuming relative past performance will continue

- Consider how if at all the value should be modified based on new conditions expected in the future