Chapter 2: The Investor & Inflation

Start with Part 1 Here

“Americans are getting stronger. Twenty years ago, it took two people to carry ten dollars’ worth of groceries. Today, a five-year-old can do it.” – Henny Youngman

- Those with fixed dollar income (including Bonds) will suffer when the cost of living rises. Stocks give the possibility of protecting against the loss of purchasing power through advances in dividend payments as well as increases to the share price

- Between 1926 & 2002 stocks beat inflation in 50/64 5-year periods (or 78% of the time)

- No matter how high the recent stock market return, high quality stocks cannot be a better purchase than bonds under all conditions (fluctuation is certain & a balanced portfolio helps psychologically weather distressing declines)

- The price of living nearly doubled between 1915 and 1920 (96.8% increase in consumer prices). Between 1940 and 1946 consumer prices increased 40%. However the long term average between 1915 and 1970 was 2.25% annually. In recent years this has fallen even lower. 1997 to 2002 had an average inflation rate of 2.2% & 2009 to 2019 had an increase of only 1.77% annually

- Fun fact: During the American Revolution, prices grew at almost 300% annually from 1777 to 1779. A pound of butter cost $12 and a barrel of flour cost $1600

- This low rate, paired with an increase in quality of many goods & price decreases in certain sectors (computers, electronics etc) may put the figure closer to 1% & has led to many economists to call inflation, “dead.” However three reasons exist to doubt this claim:

- As recently as 1972 to 1983 Consumer Price Index (CPI) grew at an annualized 9% rate

- Since 1969, 69% of the world’s market oriented economies have faced 1 year or more of 25% inflation or greater

- Rising prices allow the government (and any debt holder!) to pay off debt with “cheaper” dollars in the future. It is unlikely that the US (or any country that regularly borrows money) would aim for inflation to be completely eliminated

- Contrary to popular thought, there is no evidence that inflation has a direct effect on a companies per share earnings growth (for example by raising the value of previously existing capital & therefore the rate of earnings on capital investment — instead growth is largely attributable to reinvested profits alone). It does of course have an effect on share prices

- Mild inflation allows companies to pass along increased material costs to consumers. High inflation forces customers to reduce spending & depresses market activity

- Offsetting influences preventing increase in real profitability of corporations include:

- Rise in wage rates exceeding the gains in productivity

- Need for large amounts of new capital compressing the ratio of sales to capital employed

- Between 1950 & 1969 earnings on capital fell from 18.3% to 11.8% despite inflation. In this same period, corporate debt increased 5x (from $140.2B to $692.9B) while profits before taxes increased only 2x (from $42.6M to $91.2M). Without this increased leverage, earnings rate on stock capital would have fallen even lower. The takeaway: debt levels have played a large roll in equity prices

- Alternatives to Common Stocks as Inflation Hedges:

- Gold (and Bitcoin)

- “Things” (art, fine wine, diamonds)

- Real estate

- Treasury Inflation-Protected Securities (TIPS = US government bonds that increase in value when inflation rises)

Chapter 3: A Century of Stock Market History

“You’ve got to be careful if you don’t know where you’re going, ’cause you might not get there.” – Yogi Berra

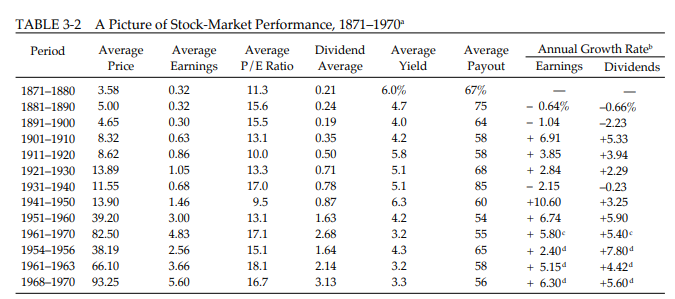

- Annual rate of stock market price advance (does not include dividend yield) between:

- 1900 & 1924 = ~3% annually

- 1924 & 1949 = ~1.5% annually

- 1949 & 1970 = ~9% annually

- 1970 & 2020 = ~7.4% annually (calculated using S&P 500 average closing price of 2,985.72 & 83.15 for 1970)

- Price to Earnings ratio (P/E) = ~14 average over modern history:

- <10 = low

- 10 to 20 = moderate

- >20 = expensive

- Intelligent investor must never forecast the future exclusively by extrapolating the past. “The only thing you can be confident of while forecasting future stock returns is that you will probably turn out to be wrong.”

- Modern pundits will claim that stocks have beaten bonds over a 30 year period & are therefore less risky and inherently more attractive moving forward – This could change!

- Similarly, just because stocks have returned a 7% historical return after inflation does not mean this will continue forever (Stock indices often ignore companies that went bust (especially with older historical data) creating a survivorship bias)

- A recent period of stellar results likely makes the stock market more risky. The value of any investment is a function of the price you pay for it.

- Stock market performance = real growth (rise of earnings and dividends + inflationary growth (general rise of prices) + speculative growth (change in appetite for stocks)

- Long term corporate earnings average 1.5-2%

- Inflation in 2019 was ~2.3%

- Dividend yield in 2020 is around 2.4%

- =Therefore ~6.2 to 6.7% annual growth expected or ~4% after inflation. Anything above this number is likely speculative (or due to above average earnings). For comparison the S&P return in 2019 was 30.43%

- When market seems precariously high:

- Don’t borrow to buy or hold securities (margin trading)

- Don’t increase your proportion of funds held in common stocks

- Consider reducing common stock holdings to maximum of 50% of portfolio and increasing bond proportion or hold as as savings deposit

- “It is the mark of an educated mind to expect that amount of exactness which the nature of a particular subject admits. It is equally unreasonable to accept merely probable conclusions from a mathematician and to demand strict demonstration from an orator” — Aristotle’s Ethics (and the work of a financial analyst falls somewhere in between these two)