Net absorption is a closely monitored and important metric to many in the commercial real estate sector. Because it is dynamic, tracking change over time, rather than a static figure such as vacancy, it can be viewed as a proxy for the momentum of a commercial rental market and its overall health. At its core, net absorption can be viewed as an approximation of changing tenant demand. It can be calculated on a micro or macro scale, tracking the change at a single building or an entire nation.

How is it calculated?

Calculations may vary slightly firm to firm, but net absorption is essentially the change in physical occupancy over a given period of time (often fiscal quarters).

In formula form this can be calculated as:

(Occupancy Q1 2019) – (Occupancy Q4 2018)

= (Inventory Q1 2019 – Availability Q1 2019) – (Inventory Q4 2018 – Availability Q4 2018)

Real world example (San Mateo County):

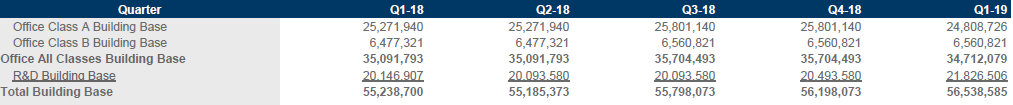

First we need the total inventory for Q1 2019 & Q4 2018

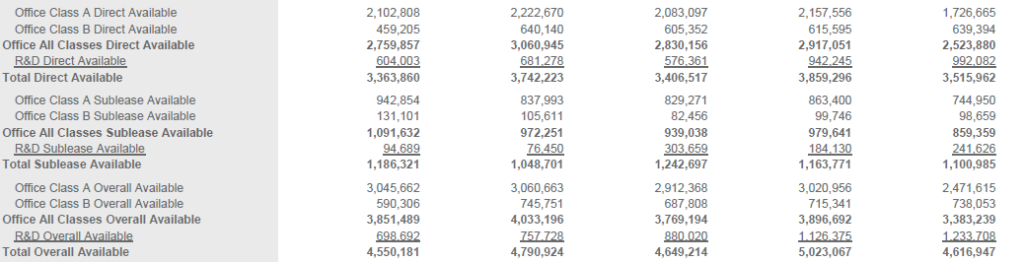

Then we need the total available space for both quarters

*** This calculation of net absorption uses both direct and sublease availability. This means space on the sublease market, even if occupied, does not count towards occupancy.

(56,538,585 SF Base Q1 2019 – 4,616,947 available SF Q1 2019) – (56,198,073 SF Base Q4 2018 – 5,023,067 available)

= 51,921,638 SF Occupancy Q1 2019 – 51,175,006 SF Occupancy Q4 2018 =

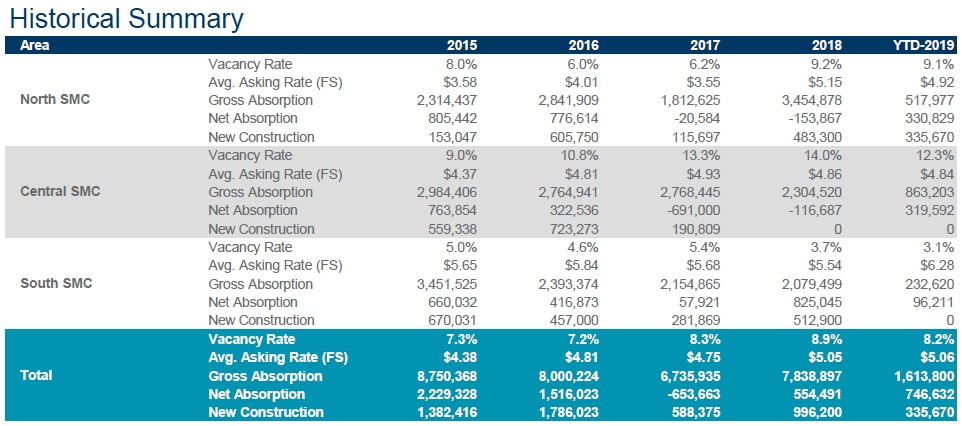

746,632 SF positive net absorption

The above formula allows for both the addition of new product as well as the removal of inventory (such as a use change or demolition) to be accounted for .

Interpreting the calculation:

A positive value or positive net absorption indicates that occupancy has increased OR that during the period being tracked, more square footage was occupied than was vacated. This could be from new firms entering the market or existing firms growing in size and is generally seen as an indication of a healthy local market. High levels of positive net absorption may result in rising prices or indicate to developers that more space is needed. Conversely, negative net absorption indicates that occupancy levels have fallen. This could be from firms leaving the market entirely or decreasing the size of their footprint. This could lead to lower rental rates and the slowing of new development.