The 1031 or 1031 Exchange is a powerful wealth building tool & the reason many investors are drawn to real estate as an asset class. Referring to section 1031 of the United States Internal Revenue Code, this process, originally adopted in 1954, allows a taxpayer to defer realized capital gains on a real estate sale if the proceeds are used to purchase a “like-kind” asset (more on that in a bit).

What is a capital gain?

Put simply, a capital gain refers to anytime that you sell an asset for more than you paid for it. This can be a stocks, real estate or other assets such as a car that is sold for profit.

Example:

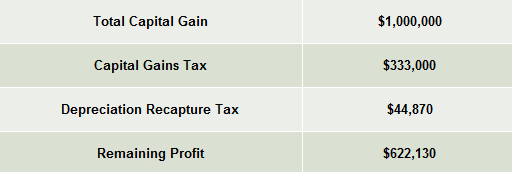

An investor in California purchases a property for $1,000,000 & 10 years later sells for $2,000,000 doubling her money. She therefore faces a $1,000,000 long-term capital gain (If an asset is held for one year or longer it qualifies as “long term”. A short term capital gain is taxed as normal income). If she chooses to realize this gain she will owe:

https://taxfoundation.org/2019-tax-brackets/ &https://www.tax-brackets.org/californiataxtable

Therefore her $1,000,000 profit is now only $667,000 (or 6.7% annual return). But wait there’s more! She will also owe depreciation recapture tax at a (maximum) rate of 25% (investors can claim depreciation against income lowering their tax liability during ownership, but have to pay this amount back if they sell the property for more than the depreciated value). Having held the property for 10 years the property will have depreciated roughly 25% (using 39 year useful life). If the building is 70% depreciable (70% of the value is derived from the improvements not the raw land) then she will owe an additional $44,870 bringing the total tax liability to $377,870 or 19% of the total sale amount and 38% of the profit.

The 1031 exchange allows an investor to instead invest these gains in a new “like-kind,” asset and defer realizing any capital gains. Our investor would therefore not yet be responsible for paying capital gains or depreciation recapture taxes.

What does “like-kind” mean?

In general, the qualifications for “like-kind,” are very lenient. As long as you are exchanging from one investment property to another (not a homestead or personal vacation property) most properties/ property types will qualify. You can exchange raw land for an office building, an apartment for a retail center etc.

Timing & logistics:

A new “exchange,” property must be identified within 45 days of the initial property sale & must close within 180 days of the sale (if the exchange is not done immediately it is known as a “delayed,” exchange & a qualified intermediary must be used to hold and transfer the funds). To receive the full benefits of an exchange, the new property or properties identified must generally be of greater value than the initial property (Yes you can exchange into multiple properties or even new construction, but this increases the complexity of the exchange).

Example of Increased Purchasing Power: If we take the funds from the two sale scenarios above and apply them to a new purchase, we see a dramatic difference in available purchasing power. Using the remaining funds as a 20% down-payment, the investor now has an additional $1,889,350 of purchasing power :

Drawbacks: While the benefits of the 1031 Exchange are clear, there are a few negatives:

- The time pressure of an exchange (180 days to identify and close) can lead to over paying for an asset (as it gives leverage to the seller) or purchasing a bad deal altogether. A bad deal can easily outweigh the tax savings of an exchange.

- While there is flexibility to choose differing property types, the funds cannot be used for stocks, bonds or other assets. This could lead an investor to be improperly diversified.

- Taxes will eventually be due. While the exchange allows for the untaxed growth of principal & profit, if and when the capital gains are realized, taxes will be due. Because the closing costs in real estate are not insignificant, if your investing horizon is short, an exchange (as well as real estate in general) may not be the best asset class.